Energy trading and risk management systems have made a huge impact on the fast-changing energy trading business. The development of our solution is based on 10 years of energy software development expertise and consultation with key users around Europe.

ETRM not only supports energy trading, transactions and risk management of gas, power, coal, CO2, FX, and other financial commodities for the CEE/SEE and Western European region; it realises these functions in real time, with real-time position calculations so you can react to any market moves quicker than other traders.

We also ensure always up-to-date market and regulatory compliance in the ever-changing energy markets. The scalable and modular structure gives a great variety of configurations with great cost saving benefits. Flexibility is also the main strength of ETRM, so implementing unique trading requirements is not a challenge to us.

Core features at a glance

The software handles gas, power, coal, CO2, FX, and other financial commodities.

There is a separate module for storing and managing data. Well-structured data is the key for flawless processes and maximum benefits. No data are deleted; therefore, data is never lost and can be tracked.

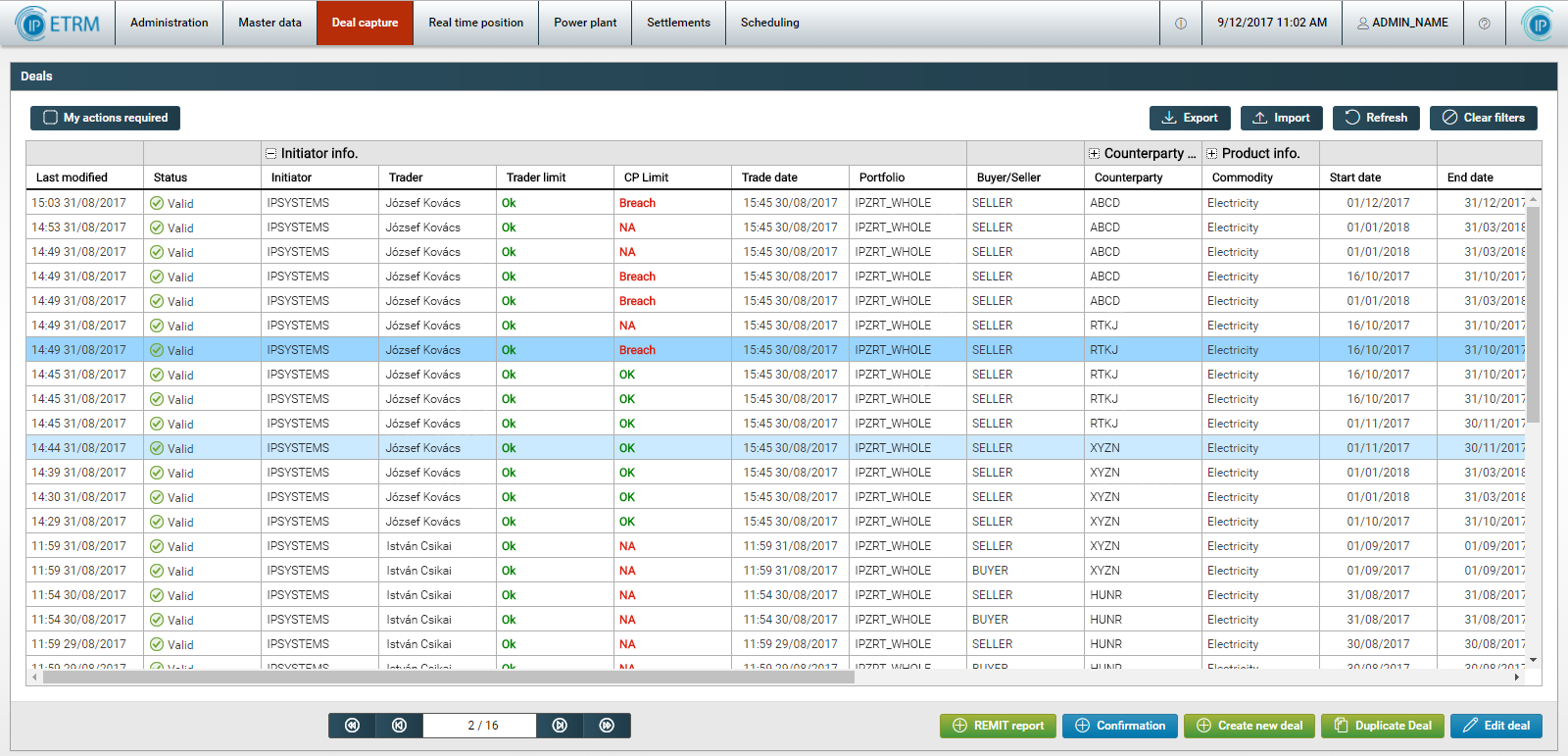

The deal overview table can be customised to make sure that users see only what they want to (or are allowed to) see. Templates for deal entry can be designed by users to meet their needs when entering deals. The creation of a deal template takes 2 minutes and filling it out based on a deal will only take 10 seconds.

The workflow and hence the lifecycle of the deals can be set up by the business. Authorized users can define which steps need to be taken between saving a deal and deeming it valid.

If something happens on one end of the process, it will be also accounted for in the other end without any delays. Decision makers can be sure about the correctness of the underlying data they’re using for their choices.

Besides the usual table view of data, ETRM also offers a map view, which is quite unique on the ETRM market.

The parameters of filters and calculations can be defined by the user; therefore, the system doesn’t preset calculations.

The system calculates the normal-delta of indexed priced deals.

The software supports the import of information from Excel files and the export of system data into Excel format.

Users can add further fields to screens, which makes it possible to customise the available list of attributes. If, for instance, a new code is required by authorities, no coding is required to place it on the screen; users may do it by themselves.

Regulatory rules are changing as markets mature; ETRM is able to keep up with the changes and requirements.

Audit support with extensive entity versioning. Easy access to version history with on-screen timeline.