Positioning offers a rock-solid, centralised solution that supports all-around business procedures associated with position keeping, optimisation and risk management in real time.

The customisable graphical representation of the trading data covers the full spectrum of energy trading from short- to long-term. When it comes to short-term trading, performance is the focal point, therefore in order to support this activity the software engine provides customisable, real-time data processing and visualisation. Not only the data is processed on the fly but risk calculations and results are available almost immediately thanks to the models we have developed through our R&D activity. The whole system is based on custom parameterisation, including special filter and calculation definitions. If you are using Positioning, profit optimisation becomes a fine-tuned process thanks to the always up-to-date positions and risk figures available anytime throughout the day.

Core features at a glance

If something happens on one end of the process, it will be also accounted for in the other end without any delays. Users can be sure about the correctness of the underlying data they’re using for their decisions.

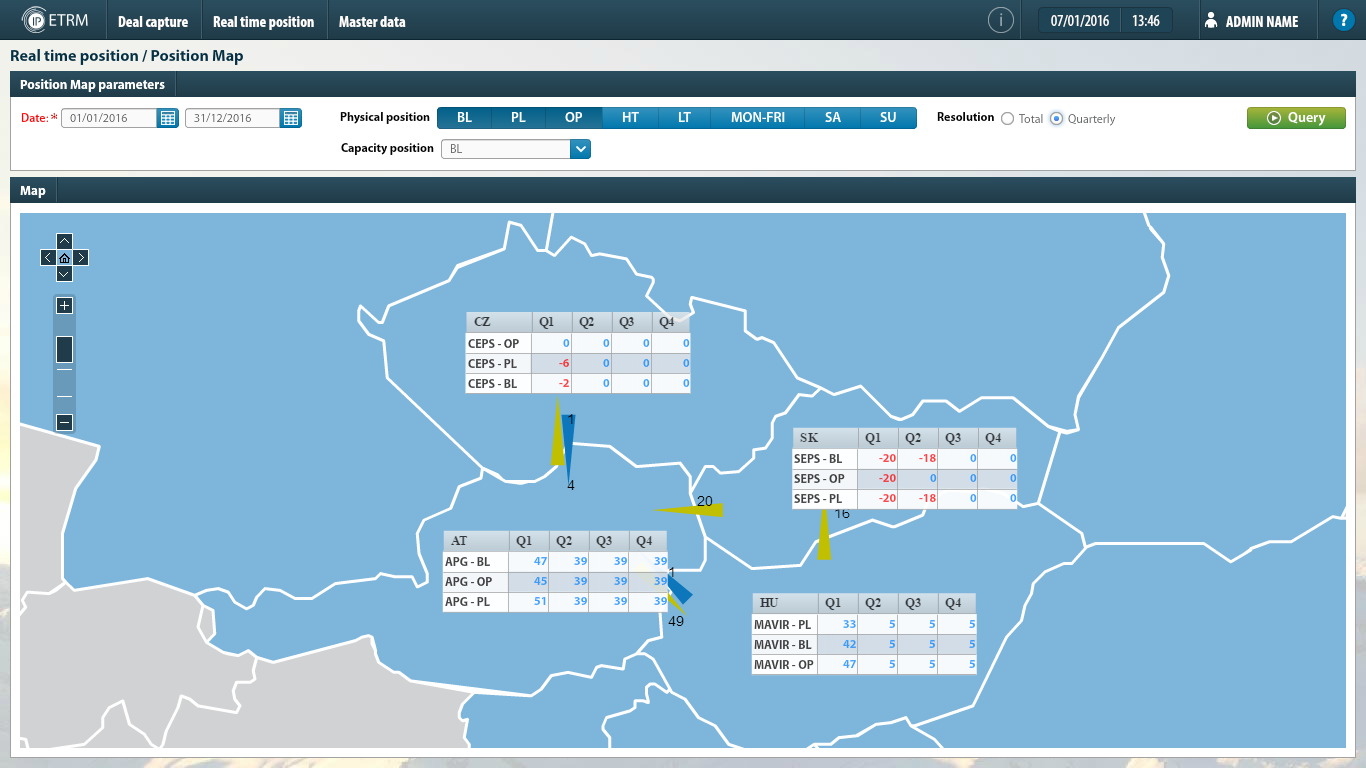

Besides the usual table view of data, Positioning also offers a map view, which is quite unique on the market.

The parameters of filters and calculations can be defined by the user; therefore, custom reports and aggregation can be done by the user without any code change by the developers.

System shows the change in the asset value due to the change of the market price of the underlying product; calculations can provide you with the amount of underlying that needs to be hedged.

Calculates the value of the portfolio current prices, i.e. contracted value vs. current market value.

Measuring the sensitivity of an option’s value to changes in the parameters having been used to the valuation.

DTD, MTD, YTD, lTD change of the value of the portfolio.

The software supports the import of information from Excel files and the export of system data into Excel format.

Users can add further fields to data structures and screens, which makes it possible to customize the available list of attributes. If, for instance, a new code is required by authorities, no coding is required to place it on the screen; users may do it by themselves.