Champions League, semifinal stage. Your favorite team loses the away leg 2-1, but they bounce back to win 2-0 at home and advance to the final with an aggregate score of 3-2. Determining the winner by adding the results of several matches is common in sports, especially football, but aggregation also occurs in many other areas of life. You can aggregate data in computing, section scores of a college test, votes in elections… Even some birds do it: they aggregate their nests in colonies.

So maybe it’s not that surprising that aggregation is now a feature in the energy sector, too: it optimizes the use of various energy resources. We’ll have a closer look at how it works, what benefits it brings to industry players and where it may be headed in the future.

Aggregators enter the competition

Recent developments such as increased digitalization and smart metering have led to the emergence of a new market player, the aggregator. An aggregator is a service provider or utility that can optimize the use of distributed energy resources (DERs) by acting as an intermediary between the different agents - consumers, producers, prosumers - within a power system.

DERs, in turn, are small or medium-sized resources that are connected to different types of networks (at low, medium or high voltage levels). They offer valuable electricity services but - on account of their size - only on a small scale, and often they cannot meet the strict market requirements regarding flexibility. When an aggregator operates them together, however, they join forces to form a single entity and can offer a sizable capacity. Those connected on the high voltage grid might even be able to provide the same services and trade on the same markets as conventional power generators - they can play in the same league as the big boys.

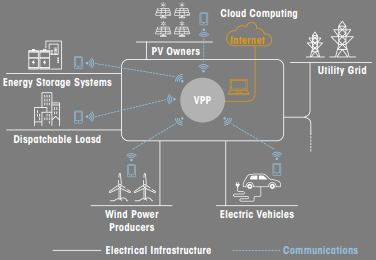

Such aggregators bundle DERs into a single entity - a virtual power plant (VPP) - which enables them to sell electricity and provide ancillary services to the grid. Note, however, that despite being centrally controlled by the VPP, DERs remain independent in terms of their ownership, as the image below shows.

Using a centralized IT system, a VPP processes data concerning weather forecasts, electricity prices and overall trends in supply and demand. It remotely controls the DERs that are integrated into it and optimizes their operation. Through VPPs, aggregators can support the gradual transformation of the power system as well as the integration of variable renewable energy. They provide more flexibility across the entire power sector, not only on the supply side, by combining existing energy asset portfolios.

Virtual power plant - a strong contender

The theoretical concept of VPPs was first formulated in the late 1990s as market liberalization in Europe began, but computer technology and regulatory frameworks were still unsuited for implementation at the time. VPPs became a reality about two decades later, with Germany’s Next Kraftwerke being one of the pioneers, and the past ten years have witnessed a growth in the number of energy companies - such as Hungary’s ALTEO - that use or commercialize a VPP.

The emphasis has also shifted over the years. Earlier on, VPPs focused mainly on front-of-the-meter generation from variable renewable resources as well as behind-the-meter loads from larger customers. Gradually, they began to incorporate residential loads and distributed storage options, too. To quote Wood Mackenzie-owned Greentech Media:

“(...) a VPP is to a traditional power plant what a bunch of internet-connected desktop computers is to a mainframe computer. Both can perform complex computing tasks, but one makes use of the distributed IT infrastructure that’s already out there.”

Virtual power plants...

- are integrated into the grid

- can aggregate a wide range of assets (e.g., solar PV, micro wind turbines, stationary battery storage, electric vehicles, microgrids, small-scale hydropower, combined heat and power)

- are managed through aggregation software

- supply real-time operating reserve capacity and offer grid-stabilizing ancillary services, as well as optimized production based on market signals.

- are aimed at wholesale markets (day-ahead and intraday markets)

As the energy transition from fossil-based systems to renewable sources gains momentum, aggregation is set to take center stage. Unlike sports, where there is only one winner, aggregators can create win-win situations by making the industry more egalitarian and market conditions fairer.

Aggregation sweeps the board

As discussed above, aggregation is advantageous to DERs by ensuring flexibility and market compatibility, but it also has considerable financial implications. The fact that DERs have the opportunity to participate in ancillary markets can increase the amount of profit for their owners who, by not having to invest in new generation capacity, have the potential to generate further revenues.

As for the grid, operators can use demand-side services provided by aggregators through load shifting, and the system can enjoy some added flexibility: aggregators can compensate for fluctuations that occur in solar or wind energy by relying on storage plants. Conversely, they can reduce the output of a connected plant - e.g., a biomass plant - when there is a surplus of solar or wind power. Indeed, the smart distribution of the power that is generated by the individual units is the real strength of aggregation. And it is due to this flexibility and versatility that some of today’s largest VPPs surpass the capacity of a fossil fuel power plant - using only carbon-neutral power.

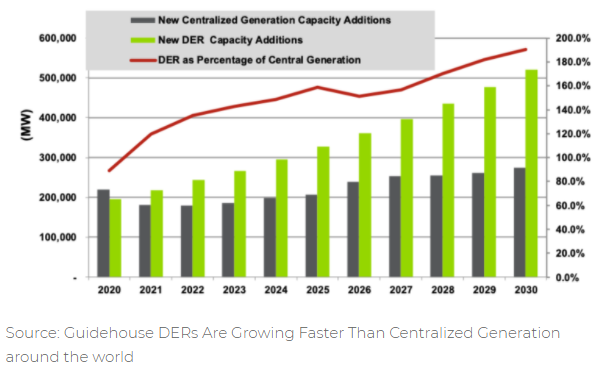

With most VPP pioneers having been acquired by major business groups over the years, not only have aggregation and VPPs been brought into the mainstream, they are in fact becoming a real driving force in the power sector. As a result of their rapid growth, DERs are now outpacing centralized generation worldwide and, according to Guidehouse Insights, a market intelligence and advisory firm covering global energy transformation, this trend will only accelerate in the coming years.

Big utility companies such as Statkraft and Enel in Europe, AGL in Australia and Generec Power Systems in the U.S. boast some of the world’s largest VPPs. By acquiring Enbala Power Networks, Generec Power Systems now owns the DER software platform that manages about 600 megawatts of flexible loads across the U.S., Canada and Australia. And while that amount could power tens of thousands of homes, it dwarfs in comparison to the volume cited in the prediction made by Wood Mackenzie, the leading energy research & consultancy firm: the United States is on course to reach a DER capacity of nearly 390 gigawatts by 2025. Meanwhile, Japan is currently developing a behind-the-meter VPP that will aggregate around 10,000 DERs - once it’s in operation, it will be a true heavyweight champion within the industry.

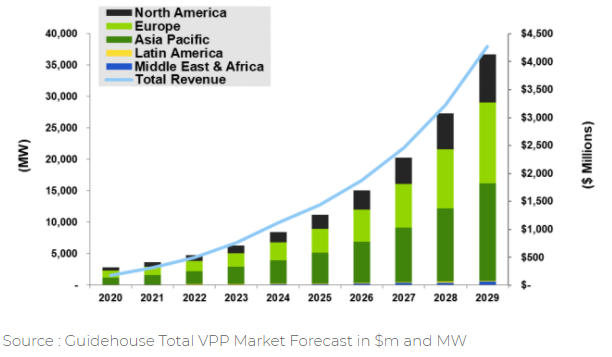

As the use of renewable energy resources in electricity generation continues to expand worldwide, the impact of VPPs is set to increase, irrespective of their size. A report published by Fortune Business Insights in late 2020 projects the VPP market to reach a worth of $2.85 billion by 2027 - a growth of over 27% during the forecast period. Guidehouse Insights makes projections of a similar trend.

So, your team has reached the Champions League final - here’s hoping they go on to lift the trophy. As for aggregation, not only is it set to get the better of all the competition in the energy league, it’s bound to hold on to its title for some time to come.

Find out how our Energy Market of Things can boost the business case for DER owners and aggregators alike.