The energy industry in 2023 was dominated by rising energy costs, with high inflation and increasing capital costs that add further complexities for industry players in 2024. On a more positive note, smaller grid assets - like battery storage systems of all sizes - are now getting dispatched more efficiently, and market participants have adopted more sophisticated optimization strategies to find value in saturated markets. Here, trading models are increasingly driven by renewable build-outs that will shift more weight to real-time electricity markets. However, revenues from these markets are challenging to rely on due to uncertainty, and the multitude of different markets also leaves some puzzled. There is a way to achieve up to 50% more revenue than the average with a refined energy trading strategy, primarily if you are operating a VPP.

By processing data from forecasts, contract data, dispatch information, price signals, and collected market data, the previous article in our VPP blueprint series got into how the optimization process of a VPP contributed to harnessing its full potential. But this is only half of the story.

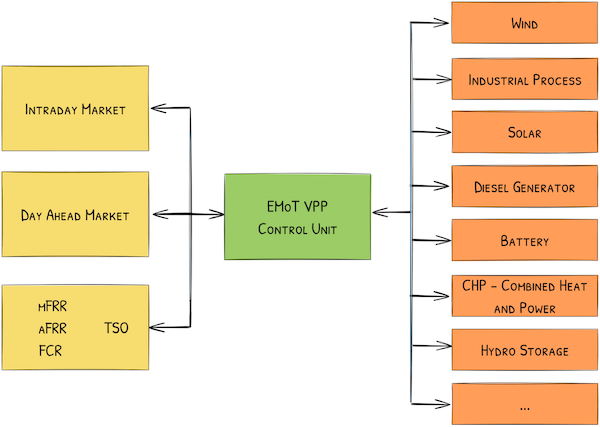

Optimization only determines real-time schedules, while trading strategies determine how optimization models are set up to maximize profits from various monetization approaches. Here, having a more diverse portfolio of assets enables you to open the gates to many more options to extract value and fully commercialize your VPP. The best way to reach peak performance of your diverse portfolio is to go for a multi-market approach.

Handling Specialized Markets

New technologies, reliability requirements, competition concerns, and regulatory policy have all contributed to an increasing number of specialized electricity markets, making finding a sound trading strategy difficult. The complexity nowadays exceeds the capacity of any human trader, as today’s strategies need to involve a high-level approach to how the VPP will participate across multiple markets over time. They must consider real-time factors like current and expected market conditions, asset capabilities, and limitations.

To get a better picture of the variety, let’s first take a look at the three different main markets where energy and energy-related services can be sold:

Day-Ahead Market Trading

The day-ahead electricity market lays the groundwork for subsequent optimizations to maximize VPP revenues, as it is where most energy is traded in the form of auctions for the next day. In many control areas, the market clears at 12PM the day before for hourly transactions from midnight, where VPP operators can submit aggregated hourly schedules for their portfolios to purchase or sell power.

Determining optimal day-ahead bids requires probabilistic forecasting of aggregated DER availability and flexibility. VPPs forecast renewable generation, expected load, and state of charge or fuel levels for battery storage and diesel generators. This estimates the net position that can be scheduled for each hour. Forecasting uncertainty is a critical challenge in the Day-Ahead Market that improves with more accurate hourly predictions.

Bidding strategies must also consider portfolio constraints like ramp rates, minimum offer quantities, and minimum/maximum run times. The goal is to maximize profits across all hours by optimizing buy and sell quantities. Revenues depend on zonal day-ahead prices that can vary significantly intra-regionally based on congestion, and locational signals are monitored to schedule DERs in high-price areas. Unsold flexibility from day-ahead bidding is available for subsequent markets. Signals from the Intraday market help adjust day-ahead schedules to capture new information and price spreads closer to real-time system conditions.

Intraday Continuous Market

As the operating day approaches, VPPs utilize intraday markets for further optimization. These markets complement day-ahead revenues and allow recapturing value from new forecast information. In many control zones, most continuous trading occurs from between 2-3 hours ahead, up to as close to 15 to 5 minutes before each product’s delivery (hourly and quarterly hour products). As forecasts are updated, VPPs resubmit bids and offers based on the latest flexibility in their portfolios.

Capturing changing price spreads between the Day-Ahead and each intraday market interval becomes increasingly essential. Assessing forecast deviations by considering factors like revised solar forecasts or equipment outages, VPP algorithms determine if upward or downward adjustments are required. The last chance to balance the portfolio is the Intraday Continuous Market, where you can place bids all day long for 1-hour, 30-minute, and even 15-minute products.

But trading closer to real-time also increases uncertainty, which VPPs must manage financially. Their objectives account for forecast risk through probabilistic techniques. Proper bidding curtails over-scheduling that could incur Imbalance settlement charges if DER flexibility falls short. But besides energy markets, VPPs will also play an essential role in keeping the grid stable, as they also provide critical balancing services to grid operators through ancillary service markets.

Ancillary Service Market Trading

Ancillary service markets compensate for flexibility for functions like frequency response and reserves. The main products vary between control zones but commonly include Frequency Containment Reserve (FCR), automatic Frequency Restoration Reserve (aFRR), and manual Frequency Restoration Reserve (mFRR).

Each service has technical requirements that determine a resource's eligibility. Assets like batteries cater well to faster FCR, while diesel generators suit sustained mFRR. VPP algorithms evaluate individual assets to optimize their service provisions. For instance, 5MW may offer FCR, while 10MW stands by for shorter mFRR activations.

Grid codes also specify availability obligations like simultaneously providing energy and reserves. PPs simulate composite bids, ensuring sufficient headroom or footroom space is available. Historical prices assist in forecasting future revenues from services. All these estimates factor into day-ahead commitments and allow reserves from unsold flexibility. Trading windows for ancillary markets commence earlier than energy, with results integrated into subsequent optimizations.

Combined with energy revenues, maximizing ancillary service provisions raises overall profitability for VPP operators and owners. This is because their valuable flexible DER attributes are highly sought after to help overcome balancing challenges.

The demand for these services is only expected to grow as the increasing share of intermittent generation requires an expansion of frequency control products. But at the same time, the current value pool for frequency services is limited, so making VPPs as profitable as possible could significantly expand this pool.

To do so, let’s stack these markets on top of each other for a strategy fully harnessing your VPP's potential.

Multi-Market Optimization, aka Revenue Stacking

Optimizing trading across electricity markets has become a vital area for revenue maximization. Individually, DERs offer limited flexibility and revenues due to their small scale. However, through aggregation, a VPP can behave like a conventional power plant capable of participating in multiple markets. By coordinating a diverse portfolio of resources, a VPP opens up new revenue streams for its constituent DERs.

This is where the "multi-market trading" or "revenue stacking" strategy becomes essential. It involves a VPP optimizing its dispatch and market participation to capture revenues from all sides: day-ahead electricity markets, intraday adjustments, and ancillary service provision for grid balancing. Coordinated across its portfolio, a VPP can then offer different services based on each DER's technical capabilities and availability on a second-by-second basis.

Compared to individual asset trading, significant increases in profitability can be achieved through sophisticated trading optimization. This requires algorithms to determine the correct bids and offers across multiple timeframes and grid services based on dynamic forecasting and constraints. Done effectively, revenue stacking can improve predictability for DER owners and yield higher overall returns for VPP aggregators and system operators.

On a technical level, revenue stacking requires VPPs to undertake integrated optimization problems that involve unit commitment and economic dispatch tools. Their algorithms simultaneously solve for schedules honoring individual asset constraints and all technical and commercial market criteria. Optimal schedules are then computed continuously, adjusting to updated forecasts from days to minutes ahead. VPP software assesses market signals, simulating dispatch costs and profits under various scenarios. Revenues are stacked by determining the right mix of day-ahead energy, intraday adjustments, and ancillary service provisions for each trading interval. The goal is to derive setpoints that deliver day-long cost-minimization while satisfying operational requirements.

Maximizing your commercial potential

By aggregating distributed energy assets into a virtual power plant, sophisticated multi-market optimization brings new revenue potential to the table previously unavailable to independent resources. Revenue stacking exhibits how coordinated scheduling across day-ahead markets, intraday adjustments, and ancillary service provisions enhance profitability. As electricity systems continue integrating renewable energy, this is how virtual power plants will play an increasing role in flexible grid integration in the big scheme of things.

The next article will discuss the tools required to manage risks in multi-market trading optimization and which strategies to choose for high trade capture performance despite renewable forecast uncertainties. We will also examine the role of intraday algorithms in maximizing flexibility revenues through dynamic price spread capture in constant closed-loop adjustments up to real-time market gates.

The Navitasoft VPP Blueprint

Follow our complete series on VPPs and the digital solutions needed to run them:

Part 1: Forecasting in virtual power plants

Part 2: Integrating virtual power plants

Part 3: Internal system integration and reporting

Part 4: Optimization in Virtual Power Plants

Part 5: Trading Strategies to Optimize Your VPP

Part 6: How to Manage Risk for Your Virtual Power Plant

Part 7: Dispatching & control of execution in virtual power plants

Part 8: Disaggregation and settlement in virtual power plants

Part 9: VPP 3.0 - The Third Generation of Virtual Power Plants