VPPs are becoming increasingly central to the landscape of renewable energy, representing a significant stride towards a sustainable future. Still, their integration into existing systems remains a considerable challenge, as an increasing number of stakeholders and a high quantity of external data interfaces need to be brought under one roof. All this we explored in our recent article “Integrating Virtual Power Plants.” However, a 360° integration of VPPs is not complete without an acute understanding of the regulatory environment, all of which touches the internal systems of a VPP. This is why, in Part 3 of our "Navitasoft VPP blueprint" series, we will focus on what you must consider regarding regulatory compliance, internal system coordination, and reporting mechanisms.

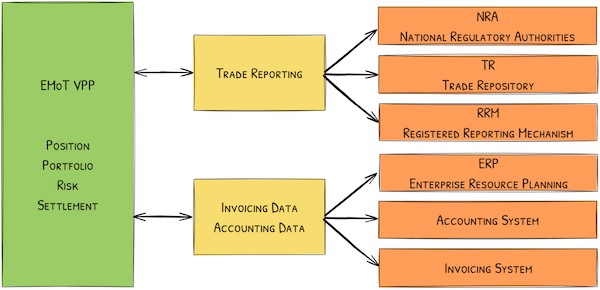

There is a sophisticated interplay between internal systems and the necessary reporting purposes, a realm often overlooked yet vital for the seamless operation and legal compliance of VPPs. Activities within VPPs need to be communicated to a wide set of different authorities.

Obligation to report

An important aspect that is sometimes overlooked when creating VPPs is that they must adhere to the Markets in Financial Instruments Directive (MiFID) and MiFID II, European regulations governing financial markets. The intricate financial transactions inherent in VPP trade operations demand meticulous record-keeping and reporting. This is where robust integration with Enterprise Resource Planning (ERP) systems becomes invaluable, as these systems streamline the financial aspects of VPP operations, from invoicing for energy sold or services rendered to managing financial records in compliance with various regulations. To create the required data sets, Trade Repositories must be integrated and designed to collect and maintain central records of derivative transactions. These integrations are crucial for VPPs engaged in financial trading activities, as they need to report to the European Securities and Markets Authority (ESMA), ensuring transparency and oversight in financial transactions.

Another critical requirement for VPPs operators is to report wholesale energy market transactions to the Agency for the Cooperation of Energy Regulators (ACER) under the Regulation on Wholesale Energy Market Integrity and Transparency (REMIT). To facilitate this, VPPs employ Registered Reporting Mechanisms (RRMs), specialized systems designed to collect, process, and submit transactional data in a format compliant with REMIT requirements. RRMs play a pivotal role in maintaining market integrity and transparency, helping to prevent market abuse, and ensuring a level playing field in the energy sector. This involves the transmission of vast quantities of data, encompassing details of every transaction and order placed by market participants.

Finally, VPPs must report to the National Regulatory Authority (NRA) to prove that the various activities comply with local regulations. This process involves detailed energy production, distribution, and trading activities documentation. Integrating NRAs is not merely a procedural formality but a strategic necessity. It ensures that VPPs operate within the legal frameworks of their respective countries, mitigating risks associated with non-compliance, such as penalties or operational disruptions. This integration demands high precision in data reporting and robust internal systems that can accurately track and report energy transactions.

Be quick on your feet

There is already a lot to consider, but the world of renewable energy, and especially that of VPPs, is still undergoing significant changes as policies and technologies are constantly evolving:

- The emergence of renewable energy sources has shifted towards short-term trading, requiring legacy platforms to adapt to real-time data processing and robust trade management to handle increased trading volumes.

- This market evolution is paralleled by a dynamic regulatory landscape, where compliance with initiatives like the EU's Sustainable Finance Disclosure Regulation (SFDR) becomes crucial for integrating environmental, social, and governance (ESG) factors into investment decisions.

- Accurate forecasting of power from renewable sources is underscored as a pivotal element for VPP success, requiring sophisticated data analysis and technological solutions like IIoT gateways and AI for efficient data acquisition and power output prediction. Implementing demand-response programs is highlighted as a strategic approach to maintaining supply-demand equilibrium, using advanced metering and monitoring to incentivize energy usage adjustments.

- Finally, integrating Distributed Energy Resources (DERs) within VPPs is marked by challenges such as the slower response times of dispatchable renewables compared to batteries, the increasing competition in the ancillary service market, and the complexity of centralized optimization in heterogeneous DER environments.

Technological advancements and different regulatory requirements, all while maintaining operational efficiency and compliance - there is so much to consider when equipping your VPP for the rapidly evolving energy market.

The global shift towards renewable energy sources has transformed trading practices and introduced new regulatory and technological landscapes that VPPs must navigate. The ability to accurately forecast energy production, implement effective demand-response programs, and integrate diverse energy resources highlights the sophistication required in modern VPP operations. There are a lot of strategic, regulatory, and technical considerations for the successful integration and management of VPPs. But the effort is worthwhile, as VPPs will play a significant role in transitioning to a more sustainable energy future.

Now, we have our VPP integrated into both environments of stakeholders and regulators, but this is just the beginning. The next frontier in this journey is 'Optimization in VPPs,' where we will explore the cutting-edge strategies and technologies that enable VPPs to fine-tune their operations. So stay with us!

The Navitasoft VPP Blueprint

Follow our complete series on VPPs and the digital solutions needed to run them:

Part 1: Forecasting in virtual power plants

Part 2: Integrating virtual power plants

Part 3: Internal system integration and reporting

Part 4: Optimization in Virtual Power Plants

Part 5: Trading Strategies to Optimize Your VPP

Part 6: How to Manage Risk for Your Virtual Power Plant

Part 7: Dispatching & control of execution in virtual power plants

Part 8: Disaggregation and settlement in virtual power plants

Part 9: VPP 3.0 - The Third Generation of Virtual Power Plants